“Accounting estimates are integral to financial statements, but often subjective and susceptible to management bias,” said James R. Doty, PCAOB Chairman, in a recent press release touting the PCAOB’s proposal to enhance the requirements for auditing accounting estimates. But why revise the current auditing standard (AS 2501)? Because auditing certain accounting estimates has proven to be a challenge to auditors as evidenced by continued deficiencies in this area noted in recent PCAOB inspection reports.

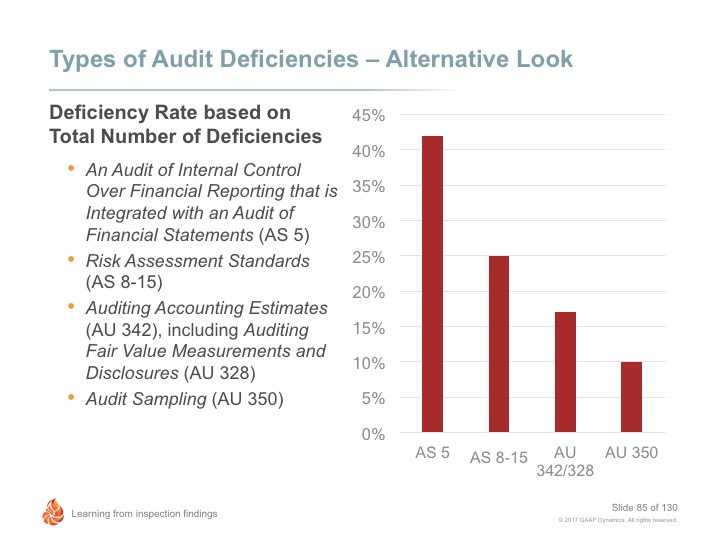

Based on our review of the 2015 PCAOB inspections of the annually inspected firms, 17% of all the audit deficiencies noted related to either Auditing Accounting Estimates (AU 342) or Auditing Fair Value Measurements or Disclosures (AU 328). Although the number of deficiencies related to these standards has improved slightly in recent years, it still ranks third, behind deficiencies related to audits of internal control over financial reporting and the risk assessment standards.

Top 5 Specific Audit Areas with Deficiencies Related to Auditing Accounting Estimates

Based on our review of the 2015 PCAOB inspection reports, the following audit areas had the most deficiencies noted that were attributed to auditing accounting estimates and fair value measurements (in order of frequency):

- Business combinations, including contingent consideration

- Revenue, including accounts receivable, deferred revenue, and allowances

- Loans, including the allowance for loan losses

- Impairment of goodwill and intangible assets

- Inventory and related reserves

Auditing Accounting Estimates – A Worldwide Problem

Within their report on 2016 inspection findings, the International Forum of Independent Audit Regulators (IFIAR) noted that nearly one-third (32%) of the inspected audits of public interest entities (PIEs) had at least one finding related to auditing accounting estimates. In fact, it was the most noted finding!

Nearly half of the auditing accounting estimates findings related to failures to assess the reasonableness of assumptions, including consideration of contrary or inconsistent audit evidence where applicable.

Other findings noted in the IFIAR report related to auditing accounting estimates included:

- Failure to perform sufficient risk assessment procedures;

- Failure to test sufficiently the accuracy of the data used; and

- Failure to take relevant variables into account.

Example Finding

Let’s review an actual finding noted in a PCAOB inspection report related to AU 342, Auditing Accounting Estimates.

AU 342, Auditing Accounting Estimates

The Firm failed to sufficiently test the issuer’s allowance for excess and obsolete inventory. Specifically, the Firm’s procedures were limited to inquiring of management regarding the methodology used to estimate the allowance; testing the mathematical accuracy of the issuer’s calculations; and, for one subsidiary, comparing the current-year allowance to the prior-year allowance, noting that the balance did not change significantly. The Firm, however, failed to evaluate the reasonableness of the significant assumptions that the issuer used in determining its allowance for excess and obsolete inventory.

This finding relates to deficiencies in applying the following paragraphs of AU 342:

Evaluating Reasonableness

AU 342, paragraph .11 states:

Review and test management’s process. In many situations, the auditor assesses the reasonableness of an accounting estimate by performing procedures to test the process used by management to make the estimate. The following are procedures the auditor may consider performing when using this approach:

- Identify whether there are controls over the preparation of accounting estimates and supporting data that may be useful in the evaluation.

- Identify the sources of data and factors that management used in forming the assumptions, and consider whether such data and factors are relevant, reliable, and sufficient for the purpose based on information gathered in other audit tests.

- Consider whether there are additional key factors or alternative assumptions about the factors.

- Evaluate whether the assumptions are consistent with each other, the supporting data, relevant historical data, and industry data.

- Analyze historical data used in developing the assumptions to assess whether the data is comparable and consistent with data of the period under audit, and consider whether such data is sufficiently reliable for the purpose.

- Consider whether changes in the business or industry may cause other factors to become significant to the assumptions.

- Review available documentation of the assumptions used in developing the accounting estimates and inquire about any other plans, goals, and objectives of the entity, as well as consider their relationship to the assumptions.

- Consider using the work of a specialist regarding certain assumptions.

- Test the calculations used by management to translate the assumptions and key factors into the accounting estimate.

Preview of 2016 Inspection Results

According to a speech by Helen Munter, Director, Division of Registration and Inspections, at the 2016 AICPA Conference on SEC and PCAOB Development, “inspections staff continue to identify significant deficiencies” related to auditing accounting estimates, including fair value measurements. According to Ms. Munter, inspections continue to “identify instances in which auditors did not fully understand how estimates were developed or did not sufficiently test the significant inputs and evaluate the significant assumptions used by management.”

Ms. Munter warns, “auditors need to continue to be vigilant in this area,” especially given the new standards on revenue recognition and the current expected credit loss model will continue to give rise to complex accounting estimates.

Proposed Changes

The PCAOB has proposed enhanced requirements for auditing accounting estimates, including fair value measurements. Why? Because, according to Martin F. Baumann, PCAOB Chief Auditor and Director of Professional Standards, “accounting estimates often represent the areas of greatest risk in an audit. The proposal focuses auditors on estimates with greater risk of material misstatement, with particular attention to addressing potential management bias.”

The PCAOB is proposing to replace Auditing Accounting Estimates (AS 2501); Auditing Fair Value Measurements and Disclosures (AS 2502); and Auditing Derivative Instruments, Hedging Activities, and Investments in Securities (AS 2503). The updated and retitled standard would be Auditing Accounting Estimates, Including Fair Value Measurements (AS 2501). We’ll cover the changes in a future post once the proposal is adopted.

Don’t forget to check out our previous blogs in this series: Audits of internal control over financial reporting and the risk assessment standards. We hope these blogs help you reduce the number of deficiencies and improve audit quality. Good luck!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.

Comments (0)

Add a Comment