Let’s Refresh! The Liquidation Basis of Accounting

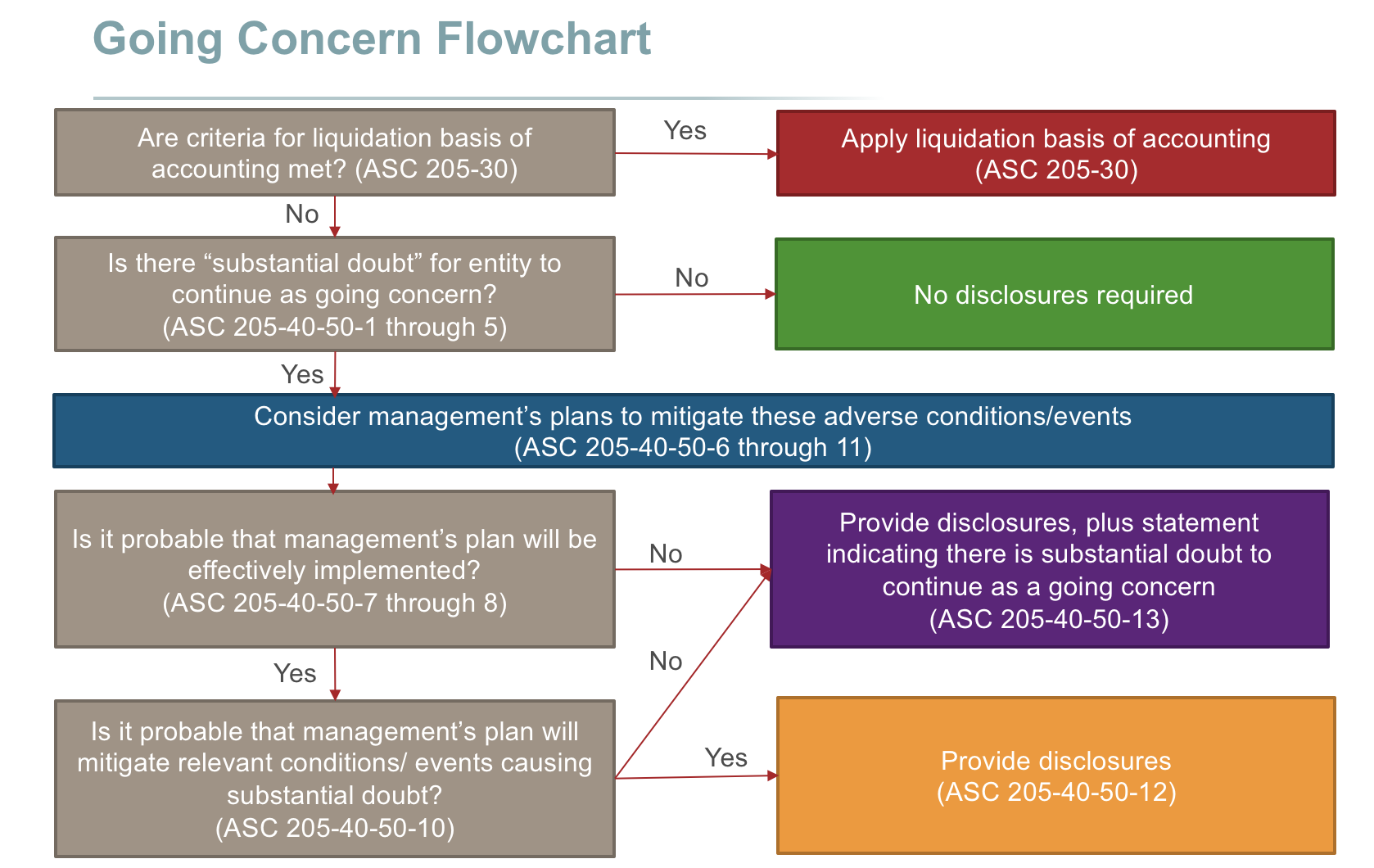

As we’ve previously discussed, it is officially management’s responsibility to assess their entity’s ability to continue as a going concern. Specifically, we discussed what management is required to disclose if “substantial doubt” exists about that ability. This guidance is contained within ASC 205, Presentation of Financial Statements, which is summarized in this flowchart:

In that post, we discussed the ramifications of identifying “substantial doubt” for an entity to continue as a going concern. But what happens if the entity answers “yes” to the first question in that flowchart? In other words, if the criteria for liquidation basis of accounting met, how should it be applied? In this post we’ll discuss the liquidation basis of accounting under ASC 205-30.

What is the liquidation basis of accounting?

Businesses generally don’t last forever, no matter how much a company’s stakeholders wish it could be true. When a business winds down, management normally sells off, or liquidates, the assets held by the entity. This is true of companies that experience a going concern issue and liquidate suddenly or unexpectedly, but it is also true of limited-life companies, like investment companies, that were established to operate for a certain period of time and then liquidate at the completion of that term.

Prior to the FASB issuing the liquidation basis of accounting guidance in 2013, there was disparity and inconsistency in practice in how an entity presented its financial statements when it was in the process of ceasing its operations and liquidating its assets. Historically, the FASB was silent on how companies that were no longer considered a going concern should be accounted. Additionally, there was disparity in practice regarding how liquidation accounting was applied to limited life entities – some companies waited until the liquidation plan was approved while others waited until the liquidation was expected to be completed within 12 months of that date.

The goal of the guidance when it was issued was to allow readers of the financial statements to be able to ascertain how much the organization will have available for distribution to investors after liquidating its assets and settling outstanding obligations.

Who is required to use the liquidation basis of accounting and when?

The liquidation basis of accounting is applicable to both public and nonpublic entities. The only types of entities that are NOT required to follow this guidance, should it apply, are investment companies regulated under the Investment Company Act of 1940. These types of entities are out of scope because they cannot legally change the way they measure their net asset values. All other types of investment companies are subject to this standard.

So, when does an entity have to apply the liquidation basis of accounting? The standard states that this basis of accounting should be applied when liquidation is “imminent”. So, what does imminent mean?

The FASB states that liquidation is imminent when the likelihood is remote that the entity will return from liquidation and either:

- A plan of liquidation is approved by the person or persons with the authority to make such a plan effective and it is remote that the execution will be blocked by other parties (e.g., those with shareholder rights); or

- A plan for liquidation is imposed by other forces (e.g., involuntary bankruptcy or perhaps a key investor redeems its investment if a fund)

For limited life entities, such as private equity funds, if a plan for liquidation was specified in the governing documents from the entity’s inception, the entity should apply the liquidation basis of accounting ONLY if the approved plan differs from the plan for liquidation that was established at inception.

How is the liquidation basis of accounting applied?

Once an investment company determines that applying the liquidation basis of accounting is appropriate, the recognition and measurement of accounts would change. Financial statement presentation and disclosures also change. The investment company must remeasure its assets, other items not previously recognized, liabilities and the accruals of expense, and income at each financial statement reporting date.

Application of the liquidation basis of accounting to assets

Assets should be measured at the amount the entity expects to receive when it settles or disposes of each asset. In some circumstances, the fair value of an asset, less cost to sell, will approximate the cash that an entity expects to collect. However, this may not always be true because all assets will not necessarily be disposed of in an orderly fashion. Additionally, the entity should include items that may not have previously been recognized under U.S. GAAP but are expected to be sold in liquidation or used in settling liabilities (e.g., trademarks). Finally, as it relates to the assets presented, the entity should accrue any estimated costs to dispose of the assets.

Application of the liquidation basis of accounting to liabilities

Liabilities should generally be presented as they normally would be under U.S. GAAP. However, the liabilities may need to be adjusted to reflect any changes in assumptions that might result from the decision to liquidate (e.g., timing of payments).

Accounting for other costs and income

An entity should accrue any amounts expected to be incurred (payroll, costs to liquidate assets, etc.) or earned (income from pre-existing orders, etc.) throughout the remaining liquidation period if a reasonable basis for estimation exists. Entities should not discount these amounts.

Remeasure at each reporting date

At each reporting date, the entity should remeasure its assets, liabilities, and accruals for disposal or other costs or income, to reflect the actual or estimated change in value since the previous reporting date.

Additional disclosure requirements

In addition to the measurement requirements, there are also additional disclosure requirements associated with implementing the liquidation basis of accounting. An example is providing information about the liquidation plan and assumptions used to prepare the financial statements. Be sure to check out ASC 205-30 for the specific requirements.

Closing thoughts

So, there you have it – a brief refresher of the liquidation basis of accounting. For a more in-depth coverage of the topic, check out our online course Liquidation Basis and Going Concern Assessment.

Need to understand how ASC 205-30 applies to investment companies? Contact us to learn more about our tailored training for the investment management industry. Ready to start learning today? Check out our Investment Management Industry Fundamentals online course collection!

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We view training as an opportunity to empower professionals to make informed decisions at the right time. Whether it’s U.S. GAAP, IFRS, or audit training, we’ve trained thousands of professionals since 2001, including at some of the world’s largest firms. Our promise: Accurate, relevant, engaging, and fun training. Want to know how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is for informational purposes only and should not be relied upon as official accounting guidance. While we’ve ensured accuracy as of the publishing date, standards evolve. Please consult a professional for specific advice.