A little while back, I wrote a blog covering the targeted improvements to hedge accounting as a result of ASU 2017-12. In this blog, we delve deeper into a specific improvement surrounding hedges of non-financial risks. ASC 815 generally provides flexibility in terms of risks that are eligible for hedge accounting; however, historically, non-financial hedgeable risks were restricted. In general, ASC 815 allows the following risks to be “hedgeable”:

- Overall fair value of a recognized asset/liability or unrecognized firm commitment (fair value hedges)

- Overall cash flows of a forecasted transaction (cash flow hedges)

- Benchmark interest rate (e.g. US Treasury, LIBOR, OIS, etc.)

- Foreign exchange risk

- Credit risk

However, these hedgeable risks were restricted for certain types of hedged items (e.g. held-to maturity securities and non-financial assets/ liabilities). Specifically, for hedges of non-financial items, ASC 815 limited hedgeable risks to:

- Overall fair value of a recognized asset/liability or unrecognized firm commitment (fair value hedges)

- Overall cash flows of a forecasted transaction (cash flow hedges)

- Foreign exchange risk

This limitation for non-financial items often limited the types of transactions that an entity was able to hedge, particularly for cash flow hedges of forecasted transactions involving a commodity.

Let’s take a look at a typical example:

Assume Norm & Cliff Brewery is a beer manufacturer and anticipates the purchase of 100,000 aluminum cans of from its supplier in six months. The cost to purchase the cans will be determined upon purchase, but has historically varied due to factors such as:

- The price of aluminum

- Transportation costs (from manufacturing plant to Norm & Cliff Brewery); and

- Conversion costs (converting aluminum into cans with desired labeling)

Ultimately when the purchase is made, the supplier charges Norm and Cliff based on the current price of aluminum, plus a fixed component for their costs associated with transportation and conversion. To hedge its risk against variable cash flows due to changes in aluminum prices, Norm and Cliff purchase a futures contract to sell aluminum (based on the quantity of aluminum to be used in the cans).

Assuming Norm & Cliff properly anticipate the amount of aluminum cans they will be purchasing, is this hedging relationship eligible for hedge accounting under ASC 815?

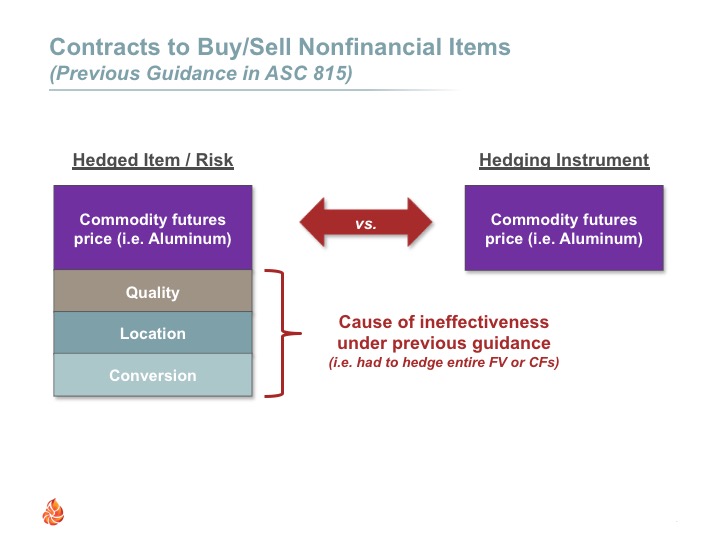

Analysis under “existing” guidance in ASC 815

Under the original guidance, this hedging relationship would NOT be eligible for hedge accounting. As this is a cash flow hedging relationship (i.e. one in which Norm and Cliff are exposed to uncertain/ variable cash flows), only a hedge of the entire change in cash flows is eligible for hedge accounting. This means the change in cash flows from the aluminum future will be compared to the change in total cash flows of the forecasted purchase of aluminum cans. This will likely fail to meet the “highly effective” hedging relationship requirement as the forecasted purchase of cans must take into account the change in expected cash flows for the entire contract, including the transportation and conversion costs. These components will be the source of differences between the two contracts.

As a result, a hedge of a non-financial risk in a forecasted purchase often would fail to qualify for hedge accounting.

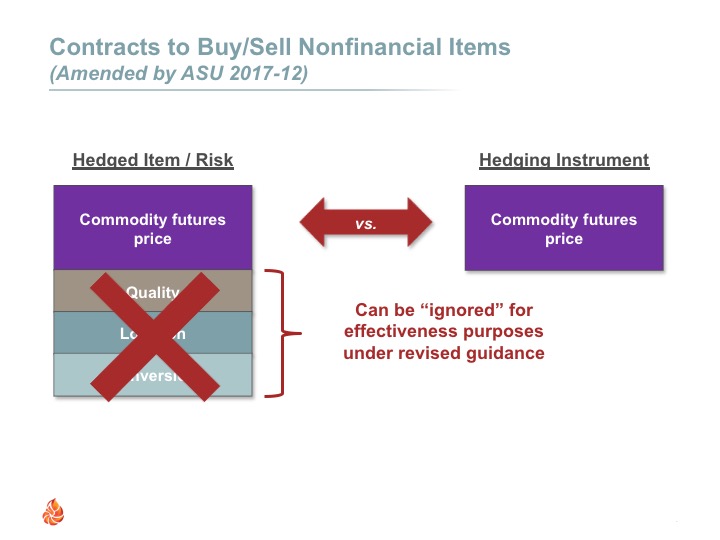

Analysis under the amended guidance in ASC 815 (under ASU 2017-12)

Under the amended guidance, entities are able to identify a “contractually specified component” of a non-financial item as the hedged risk in a cash flow hedging relationship. With this change, Norm and Cliff can isolate the hedging relationship as the variability in cash flows in its forecasted purchase of aluminum cans due to changes in the price per pound of aluminum as compared to the aluminum futures contract. By isolating this contractually-specified component, the hedging relationship is more perfect, resulting in the likelihood of a highly effective hedging relationship.

To apply this improvement, the hedged risk must relate to an index or price explicitly stated in the contract or governing agreements that is not linked to the company’s own operations. This also applies to acquisitions or sales even if “contracts” don’t exist, as long as it is expected that terms of the forecasted transaction will meet criteria and it is verified once executed. However, the contract cannot introduce any extraneous terms that are outside the normal course of business to be eligible.

Also, in order to apply this hedging strategy, hedge documentation must be very specific and adequately define the hedged risk and the contractually-specified component.

Aligning Accounting with Risk Management

So, as you can see, the inclusion of “contractually-specified” risks for non-financial risks opens the door for more eligible hedging relationships and better aligns our accounting model with the way a company sees and manages its risks inherent in running its business.

In future blogs, we will look at more hedging strategies that have been improved and aligned with the way an entity is managed. Stay tuned!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.

Comments (0)

Add a Comment