Example: Accounting for Unasserted Claims (ASC 450)

Most of us remember the accounting for contingencies under ASC 450: Accrue a liability when loss is probable (which is defined as “likely” under U.S. GAAP) and reasonably estimable. Fairly simple. But, what about unasserted claims? This post summarizes the accounting for unasserted claims under U.S. GAAP, using a worked example to illustrate key learning points.

Introducing unasserted claims

In the rush to close the books, companies can easily overlook unasserted claims, which arise when the injured party has not yet notified the entity of a possible claim or assessment. You can see how these claims may be easy to overlook given that the company generally does not know they exist! Contingencies involve uncertainty about an existing condition, situation, or set of circumstances that will be resolved when one or more future events occur or fail to occur. Unasserted claims meet the definition of a contingency. In simplistic terms, I think of unasserted claims as “potential claims”. They are “potential claims” because the claim has yet to be made but the entity still has a risk of loss due to their prior actions.

Let’s look at a quick example.

Example: Unasserted claims

Hamlet Bank has a home lending operation that is headed up by Claudius whose approval policies have always been a bit strange. He has repeatedly discriminated against granting home loans to people with small ears. During conversations with in-house counsel, you realize that discriminatory lending practices are now starting to get a lot of press and many banks have settled similar lawsuits for substantial amounts. Furthermore, in-house counsel stated it was “only a matter of time” before Hamlet Bank’s discriminatory lending practices were known by all and substantial fines levied.

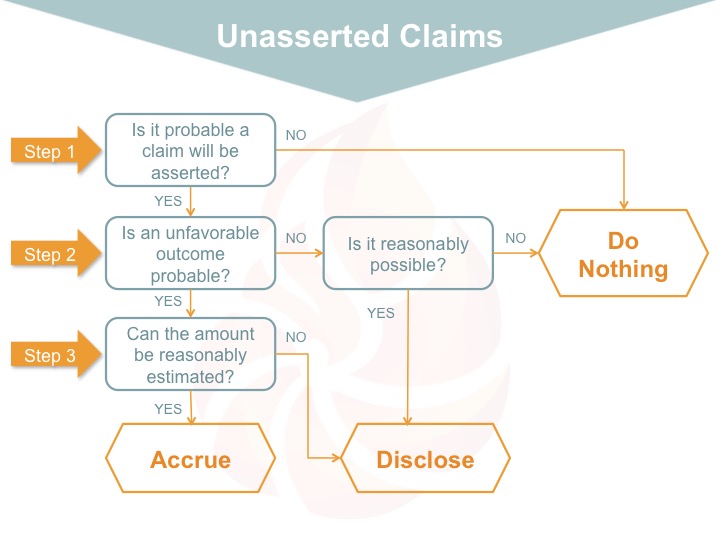

Step 1: Determine the probability a claim will be asserted

Accounting for unasserted claims follows the same process as loss contingencies with an additional initial step or consideration – we’ll call this Step 1 – which asks the question, is it probable the claim will be asserted? The FASB has defined probable as the future event or events are likely to occur. Let’s assume for a moment it was not likely a claim would be asserted in the future, in that case no further action, meaning accrual or disclosure, would be required. Based on the information provided in our example, it appears probable a claim will be asserted in the future; therefore, we’ll move to Step 2.

Step 2: Evaluate the likelihood of an unfavorable outcome

Step 2 involves considering the likelihood of an unfavorable outcome. Our example indicates Hamlet is potentially facing an unfavorable outcome. Evaluating this likelihood or probability is where things can get a bit murky. According to ASC 450, the probability can range from remote to probable. Exactly where within the range the probability of an unfavorable outcome falls helps determine whether the unasserted claim contingency should be accrued, disclosed, or ignored for financial reporting purposes.

If the probability of an unfavorable outcome were remote, no accrual or disclosure would be required. At the other end of the spectrum, if an unfavorable outcome was probable (meaning likely) of occurring, the entity would need to determine if they had the ability to estimate the amount of the loss. The area of the spectrum between remote and probable is defined by FASB as reasonably possible, meaning an unfavorable outcome is more than remote but less than likely. If an unfavorable outcome is reasonably possible, accrual is not required, however the entity should still disclose the contingency.

Step 3: Estimate the amount of loss

With respect to disclosures, ASC 450 requires the entity to disclose the nature of the unasserted claim or loss contingency, and either an estimate of the possible loss, a range of the possible loss, or a statement that such an estimate cannot be made, be disclosed.

Step 3 relates to estimating the amount of loss. For unasserted claims where an unfavorable outcome is probable, entities need to determine if the amount of loss can be reasonably estimated. If an entity can reasonably estimate the amount of the unasserted claim, they would be required to accrue the future loss. Alternatively, no accrual would be made if the entity were unable to reasonably estimate the amount of the unasserted claim; however, in this instance they would be required to disclose the unasserted claim.

The flowchart below follows the process discussed above and can be a useful tool when evaluating the proper accounting for unasserted claims.

Solution: Unasserted claims

In our example, the probability of an unfavorable outcome for Hamlet appears to be at least reasonably possible, if not probable. If reasonably possible, Hamlet would be required to disclose the unasserted claim as a loss contingency. If the likelihood of an unfavorable outcome for Hamlet were probable, they would need to move on to Step 3 to determine if an estimate of the amount of loss could be made. However, the example did not provide enough information to make such an estimate. Regardless, Hamlet should disclose unasserted claim and state that an estimate of loss cannot be made as of the reporting date.

Learn more about ASC 450

We hope this quick example has helped you understand the accounting for unasserted claims under ASC 450.

And if you’re still thirsty for more knowledge, take a moment to check out our eLearning, Contingencies and Guarantees, (which will earn you 1.0 hour of CPE credit) available on the GAAP Dynamics Learning Library!

“Though this be madness, yet there is method in it!”

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We view training as an opportunity to empower professionals to make informed decisions at the right time. Whether it’s U.S. GAAP, IFRS, or audit training, we’ve trained thousands of professionals since 2001, including at some of the world’s largest firms. Our promise: Accurate, relevant, engaging, and fun training. Want to know how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is for informational purposes only and should not be relied upon as official accounting guidance. While we’ve ensured accuracy as of the publishing date, standards evolve. Please consult a professional for specific advice.