Accounting for Repurchase Agreements under ASC 860

This is Part 2 in our series on repurchase agreements. In Part 1 we introduced repurchase agreements, including the reasons why banks enter such transactions. In this post, we discuss the accounting for repurchase agreements under ASC 860, Transfers and Servicing and walk through an example repurchase agreement transaction, including the related journal entries.

Accounting guidance (ASC 860)

The accounting for repurchase agreements depends on whether the transaction is deemed to be a sale or a secured borrowing. ASC 860, Transfers and Servicing addresses the transfers of financial assets and provides the applicable guidance. If the transaction is deemed a sale, the seller/borrower (the “transferor”) will derecognize the securities transferred and record a gain or loss on the sale. If the transaction is deemed a secured borrowing, the securities transferred remain on the balance sheet of the transferor (i.e., no derecognition) and no gain or loss would be recorded.

Accounting for transfers is all about control!

The determination of whether or not the transfer of the securities (collateral) qualifies for derecognition is based on whether or not “control” has been relinquished by the transferor. In order for control to have been relinquished, the transferor mush surrender control in each of the three ways presented below.

If the transfer of securities qualifies for derecognition (by transferring control in ALL 3 ways), the transaction is deemed a sale of the securities and a forward contract to purchase the securities back at a later date. However, if it is determined that derecognition is not appropriate for the transfer of securities (because the transferor retains control over that collateral), then the transaction is accounted for as a secured borrowing. This means the securities would remain on the balance sheet of the transferor, with no gain or loss reported on the sale (i.e., there is no derecognition of the collateral by the transferor). In most cases, repos are accounted for as secured borrowings given the nature of the transaction as described below.

Effective control

Let’s circle back to the concept of effective control because this is the control transfer requirement that typically fails for repurchase agreements. To maintain effective control (and thus fail the control transfer requirement), an agreement that both entitles and obliges the transferor to repurchase or redeem the securities before their maturity is needed to maintain the transferor’s effective control over those assets transferred.

For the transferor to maintain effective control in a repo, all of the following must exist:

- Assets to be repurchased are the same or substantially the same as those transferred

- Repurchase is before maturity of assets, at fixed or determinable price

- Agreement is entered into concurrently with transfer

Note that if all of the above criteria are not met (and the transferor relinquishes control based on the transfer arrangement), the transaction is accounted for as a sale and a forward purchase agreement.

An exception to the above characteristics exists in ASC 860 related to repurchase-to-maturity transactions – these are to be accounted for as a secured borrowing as if the transferor maintains effective control.

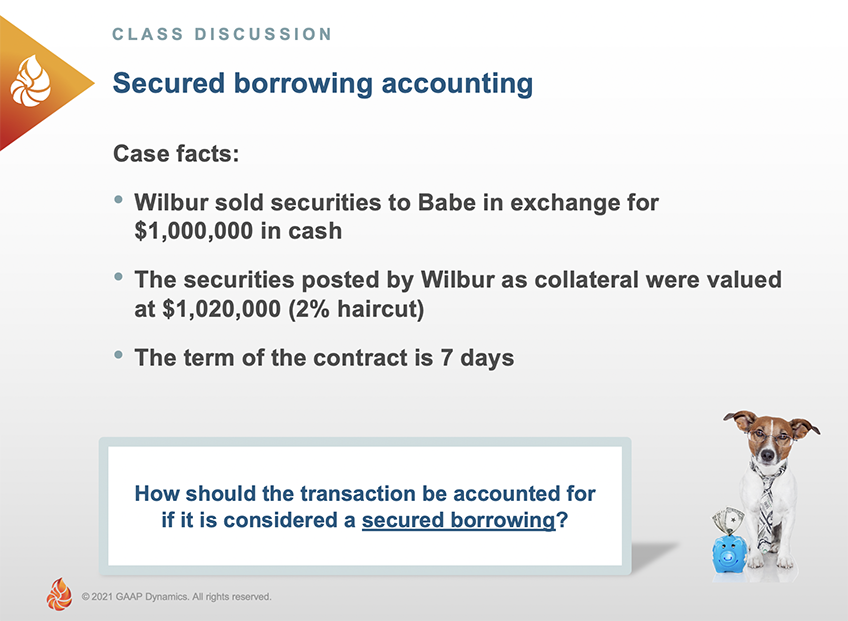

Example: Accounting for repurchase agreements

Let’s continue with our scenario from the video in Part 1. The case facts are listed below.

This transaction would be considered a secured borrowing.

The following journal entries will be made by Wilbur (the transferor) and Babe (the transferee) to record the transaction:

Initial transfer of the securities and receipt of cash

From Wilbur’s perspective as the seller/borrower, they would record the cash received from Babe and credit the “Repurchase agreement” liability account as follows:

| Dr. Cash | 1,000,000 | |

| Cr. Repurchase agreement | 1,000,000 |

Babe, as the buyer/lender, will recognize an asset, “Reverse repurchase agreement,” with a corresponding credit to cash as follows:

| Dr. Reverse repo | 1,000,000 | |

| Cr. Cash | 1,000,000 |

Recording the collateral

But what about the securities posted as collateral? Remember, although Babe (buyer/lender) has received collateral in the form of securities valued at $1,020,000, these are not recognized on Babe’s balance sheet, as the securities are still under the “control” of Wilbur (seller/borrower). That said, Babe would record a memo entry to indicate that they have possession of the securities as collateral, making appropriate disclosures in the financial statements.

Wilbur (seller/borrower) continues to recognize the securities posted as collateral in their balance sheet. However, they would reclassify (or parenthetically disclose on the face of the balance sheet) these securities, noting that they are pledged as collateral or encumbered.

Recording the interest income and settlement of the transaction

Interest income and expense is required to be accrued over the outstanding period of the repurchase agreement using the effective rate method, consistent with interest income/expense recognition requirements of U.S. GAAP.

This means Wilbur, as the seller/borrower, needs to accrue interest expense on the $1,000,000 owed to Babe (buyer/lender) over the 7-day transaction term. For purposes of this case, let’s assume the interest accrued was $480. When Wilbur settles the repo obligation, they will return the $1,000,000 plus interest as follows:

| Dr. Repurchase agreement | 1,000,000 | |

| Dr. Interest expense | 480 | |

| Cr. Cash | 1,000,480 |

Once this obligation is paid, Babe will return the securities to Wilbur. However, Wilbur does not need to record a journal entry related to the return of the securities because the securities never left their balance sheet! That said, Wilbur would reclassify the securities noting the fact that they are no longer out as collateral.

From Babe’s perspective, as the buyer/lender, they would record receipt of the cash and recognize interest income as follows:

| Dr. Cash | 1,000,480 | |

| Cr. Reverse repo | 1,000,000 | |

| Cr. Interest income | 480 |

Other considerations related to repurchase agreements

Repurchase agreements can be a very complex topic. Here are two considerations to be mindful of when dealing with these transactions:

Defaults

In the event of a default, the buyer/lender is “secured” because they have securities as collateral, hopefully valued at more than the receivable (i.e., reverse repurchase agreement). Therefore, upon default the buyer/lender would derecognize the receivable related to the cash lent ($1,000,000 in our example) and replace it with the assets held as collateral recorded at their fair value ($1,020,000 in our example). Any difference in value ($20,000 in our example) is recognized as a gain/loss or is returned to the counterparty (depending on the terms of the agreement). The seller/borrower who defaulted would derecognize the assets pledged as collateral and derecognize the obligation to return cash. Any differences in values will result in a gain/loss on settlement.

Note that these default entries assume that the “liability has been extinguished” and both parties are being forgiven of their debt, in return for the collateral.

Netting

Netting of repos in the balance sheet is one of the few areas under U.S. GAAP that have specific netting rules beyond the basic netting criteria.

Amounts recognized as payables under repurchase agreements and amounts recognized as receivables under repurchase agreements may be offset in the balance sheet, but only if all of the criteria found in ASC 210-20-45-11 are met.

U.S. GAAP training for banks

We hope this two-part series on the accounting for repurchase agreements has helped you with respect to this complex topic. Obviously, there are many other industry-specific transactions entered into by banks. Need U.S. GAAP training specifically related to banks? Look no further than our Banking Industry Fundamentals and Advance Banking Industry Fundamentals course collections, or reach out to us directly to talk about tailored, industry-specific training for your team!

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We view training as an opportunity to empower professionals to make informed decisions at the right time. Whether it’s U.S. GAAP, IFRS, or audit training, we’ve trained thousands of professionals since 2001, including at some of the world’s largest firms. Our promise: Accurate, relevant, engaging, and fun training. Want to know how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is for informational purposes only and should not be relied upon as official accounting guidance. While we’ve ensured accuracy as of the publishing date, standards evolve. Please consult a professional for specific advice.