The Measurement Alternative Under ASC 321

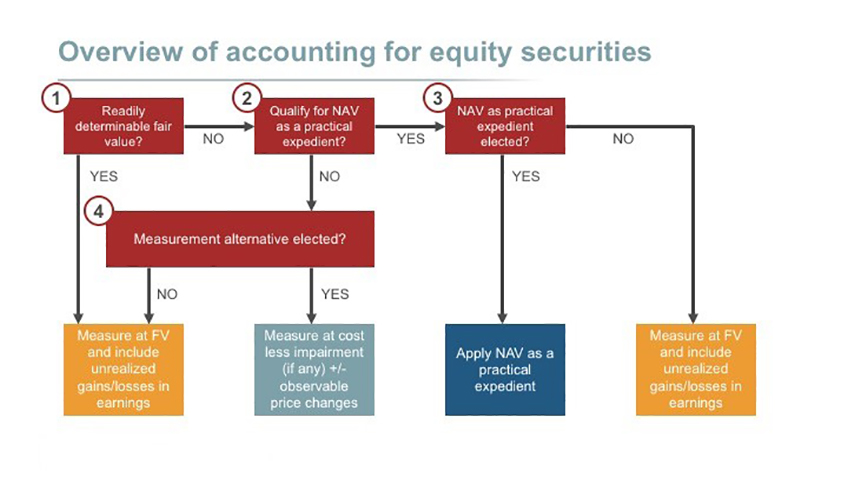

If an investment in an equity security does not have a readily determinable fair value and it is not eligible for use of NAV as a practical expedient, ASC 321 permits the use of a measurement alternative.

If you need a reminder on how to account for equity securities, check out our eLearning course: Investments: Equity Securities. Now, back to the measurement alternative, which is the focus of this blog. One important item I want to remind you of is that the measurement alternative is not required; it is an election available to companies for certain investments in equity securities that qualify for its use. If this alternative method is not elected, an equity security must be measured at fair value with any changes in fair value immediately included in earnings. However, if a company elects to use the measurement alternative, ASC 321 prescribes the subsequent measurement for such investments. Note that the election is made separately for each investment and should be applied consistently each period. Let’s discuss some of the important considerations when it comes to electing the measurement alternative.

Observable price changes

Below is a summary of how the measurement alternative, if elected, should be consistently applied each reporting period to determine the carrying value of an investment:

Remember, all investments in equity securities within the scope of ASC 321, including those for which the measurement alternative is being used, are initially measured at cost. Before we discuss impairment, I’d like to first talk about observable price changes.

If a company identifies an observable price change in an orderly transaction for an identical or similar investment of the same issuer, ASC 321 requires the entity to measure the equity security at fair value as of the date that the observable transaction occurred (not the reporting date). Let’s break this down a bit:

- When identifying if any observable price changes have occurred, a company should only consider relevant transactions that occurred on or before the balance sheet date that are known or can reasonably be known. Additionally, a company can make a reasonable effort to identify any observable price changes, but it does not need to conduct an “exhaustive” search.

- The key here is that the observable price relates to the identical (or a similar) investment of the same issuer. To identify whether a security issued by the same issuer is similar to the equity security in question, the company should consider the different rights and obligations of the securities (e.g., voting rights, distribution rights, and preferences).

Forced transactions should be ignored when determining if an observable price exists. In addition, bona fide offers and broker quotes are not considered an observable price unless they represent an actual transaction.

Impairment

Impairment is a condition that exists when the carrying amount of an asset (e.g., an investment in an equity security) exceeds its fair value. Impairment considerations apply for equity securities accounted for using the measurement alternative. Why? Because, if the investment is measured at fair value with unrealized holding gains and losses recorded in earnings, any impairment loss would already be recorded in earnings! Therefore, each reporting period, a company should make a qualitative assessment to evaluate whether the investment is impaired. If this qualitative assessment indicates that the investment is impaired, then the investment should be written down to its fair value. This means that the investment’s fair value will need to be determined in accordance with the principles of ASC 820. The difference between the fair value of the investment and its carrying amount is the impairment loss, which should be included as part of net income. Let’s take a look at an example:

Valentine cannot “reverse” the $250,000 impairment charge. Although the fair value of the Penelope investment went up, Valentine is not reporting this investment at fair value because it has elected to use the measurement alternative. U.S. GAAP does not allow an impairment to be reversed! The only way Valentine can increase the carrying value of the investment is if there were an observable transaction. However, the case facts stated there were no observable price changes noted; therefore, the investment’s carrying value remains at $750,000.

Closing thoughts

A company should stop applying the measurement alternative when the investment ceases to qualify for its use such as when the investment has a readily determinable fair value, or the investment becomes eligible to use NAV as a practical expedient. Companies should also reassess the eligibility for using the measurement alternative each reporting period. Additionally, companies are allowed to change from the measurement alternative to fair value provided they do so for all identical and similar investments of the same issuer. However, such a change would be irrevocable!

If you’d like to learn more about the measurement alternative under ASC 321, let us know! As mentioned above, we have a fun, interactive course on equity securities, which is also available as part of Banking Industry Fundamentals collection.

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We view training as an opportunity to empower professionals to make informed decisions at the right time. Whether it’s U.S. GAAP, IFRS, or audit training, we’ve trained thousands of professionals since 2001, including at some of the world’s largest firms. Our promise: Accurate, relevant, engaging, and fun training. Want to know how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is for informational purposes only and should not be relied upon as official accounting guidance. While we’ve ensured accuracy as of the publishing date, standards evolve. Please consult a professional for specific advice.