Loan Participations vs. Syndications: What’s the Deal?

Loan participations and loan syndications are terms often used interchangeably to describe a lending arrangement involving more than one lender; however, for accounting and reporting purposes, these are two different types of transactions with unique considerations and issues. While both loan participations and syndications involve multiple lenders, the way each is structured results in different accounting issues, including derecognition under ASC 860 and recognition of fees under ASC 606 and/or ASC 310. This post walks you through each of these transactions and summarizes the accounting for a loan participation and a loan syndication so you can understand the differences between the two!

We get a fair number of questions about participants and syndication when conducting banking industry training. You can find this banking-related topic (and many more) in our Banking Industry Fundamentals and Advanced Banking Industry Fundamentals eLearning course collections available on the GAAP Dynamics Learning Library.

Accounting for a loan participation

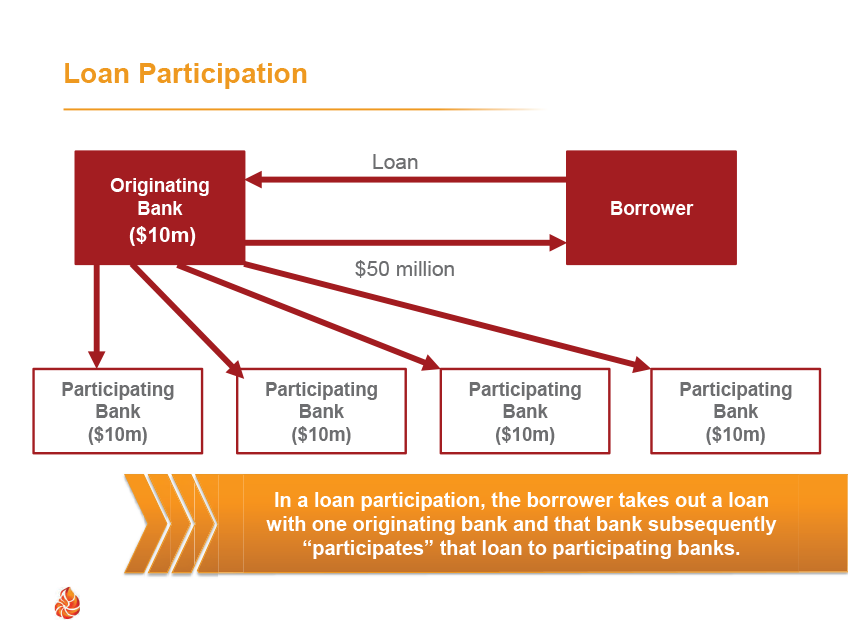

In a loan participation, a bank will originate a loan to a borrower. This is the only loan the borrower enters into. Subsequently, or concurrently, with the origination of this loan, the originating bank arranges a participation with other lenders. Under the participation arrangement, the participating banks agree to assume the risks and rewards of a portion of this loan by transferring funds to the originating bank in return for the rights to cash payments for that portion of the loan participated out to the participating bank.

In a loan participation, the originating bank enters into several lending arrangements. The first transaction is the loan origination to the borrower. This transaction will follow the normal accounting for loans under ASC 310. The unloading of a portion of the loan to participating banks represents a “transfer of a financial asset” (i.e. the loan, or a portion of the loan) and must be assessed for derecognition under ASC 860. This analysis involves determining if the participating loan represents a “participating interest” under ASC 860 and further whether control over the participating loan has been relinquished by the originating bank.

Accounting for a loan syndication

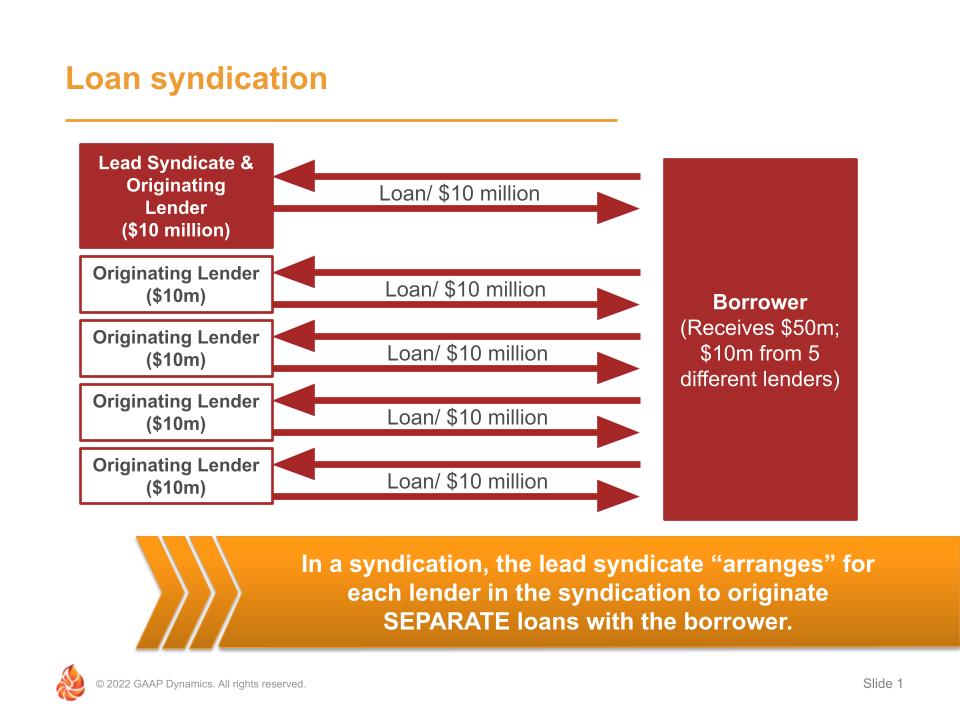

In a loan syndication, the bank with the “relationship” with the borrower likely does not want to assume the risk of issuing such a large loan. As a result, rather than underwrite the entire loan and look to participate it out to other banks, the lead bank acts as a “syndicate”, matching the borrower up with multiple lenders, each of which underwrites and originates its own loan to the borrower. As a result, there are multiple loans issued by numerous banks to the one borrower.

Loan syndications do not involve any “transfers of financial assets” as each loan in a syndication is between a respective originating bank and the borrower. As a result, ASC 860 and the analysis of derecognition is not an issue. However, there are some issues for the lead syndicate bank involving revenue recognition related to the fees it collects from the borrower. Some of these fees may represent “syndication fees” for arranging the deal, as well as typical lenders fees for the loan it has underwritten itself. Also, these arrangements may involve the lead syndicate servicing the series of loans on behalf of the syndicate banks. For these loans, other than its own originated loan, the lead syndicate will need to recognize a servicing asset (or liability) in accordance with ASC 860.

How do distinguish between loan participations and loan syndications?

As it is illustrated above, these two arrangements (a loan participation and syndication) have unique terms even though they achieve the same economic result. Therefore, the only way to know whether you are dealing with a participation or syndication is the READ the loan agreements! Careful consideration should be given to the legal underwriters and parties to the contract, contractual terms of the instruments, and other conditions to make a final analysis. Often it is a legal determination that will dictate whether it is a loan participation or syndication. Once this determination is made, it’s on to the accounting analysis!

Closing thoughts

Distinguishing between a loan participation vs. a loan syndication can be tricky and, as we discussed, can lead to very different accounting results. Hopefully, this post has helped you, but if you still have questions, let’s chat! And if you need banking training, check out our our Banking Industry Fundamentals and Advanced Banking Industry Fundamentals eLearning course collections or contact us today for a tailored training for your team.

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We view training as an opportunity to empower professionals to make informed decisions at the right time. Whether it’s U.S. GAAP, IFRS, or audit training, we’ve trained thousands of professionals since 2001, including at some of the world’s largest firms. Our promise: Accurate, relevant, engaging, and fun training. Want to know how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is for informational purposes only and should not be relied upon as official accounting guidance. While we’ve ensured accuracy as of the publishing date, standards evolve. Please consult a professional for specific advice.