Fair Value Measurements

Accounting resources for ASC 820 and IFRS 13

Do you feel that fair value is everywhere in the world of accounting? Undoubtedly, it is one of the most widespread accounting concepts. There are many items throughout U.S. GAAP and IFRS that are required to be measured at fair value, in accordance with ASC 820 or IFRS 13, Fair Value Measurement. These items could be measured on either a recurring or non-recurring basis.

To help you master fair value measurement accounting, we published this page to serve as a resource guide. It brings together a compilation of fair value measurement accounting issues, references, and links to useful content on the topic. This includes our fair value accounting eLearning courses.

Welcome video

Accounting issues

While separate accounting topics address what and when to measure at fair value, ASC 820 and IFRS 13 provide a principle-based fair value framework. This framework enhances consistency and comparability in fair value measurements for financial reporting.

Definition of fair value

Both frameworks define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Key concepts to this definition include:

The Transaction: A fair value measurement assumes the transaction to sell the asset or transfer the liability takes place in the principal market.

The Price: Fair value is the price that would be received to sell an asset or paid to transfer a liability under current market conditions. In other words, it is an exit price.

Market Participants: Fair value of an asset or a liability must be measured using the assumptions that market participants would use when pricing the asset or liability, assuming that market participants act in their best economic interest.

Orderly Transaction: An orderly transaction is a transaction that assumes exposure to the market for a period before the measurement date to allow for marketing activities that are usual and customary for transactions involving such assets or liabilities.

Determining these components of fair value and applying the principles of the fair value framework are not always straightforward. Significant judgment and assumptions are sometimes needed to estimate fair value, which can include determining the principal market, establishing an exit price, identifying the type of transaction, and determining the market participant’s perspective.

Let’s review some of the accounting issues and key principles of the fair value framework.

Principal market

As we discussed, fair value is the exit price in the principal market. But what is meant by the principal market? And how does one go about determining it?

ASC 820 requires entities to determine the principal market based on the market with the greatest volume and level of activity for the asset or liability. Unless there is contrary evidence, entities should presume that the market they typically use for transactions is the principal market.

If the principal market is not determinable, then the most advantageous market should be used to determine fair value.

A reporting entity does not need to undertake an exhaustive search of all possible markets to identify the principal market or, in the absence of a principal market, the most advantageous market, but it should take into account all information that is reasonably available.

Different entities may have different principal markets for identical assets or liabilities depending on their activities and which markets they can access.

Valuation techniques to determine fair value of financial assets

Valuation techniques that are appropriate to the circumstances, and for which sufficient data are available, should be used to measure fair value. ASC 820 identifies the following three valuation approaches:

Market approach – A valuation technique that uses prices and other relevant information generated by market transactions involving identical or comparable (i.e., similar) assets, liabilities, or a group of assets and liabilities, such as a business.

Income approach – A valuation technique that converts future amounts (e.g., cash flows, or income and expenses) to a single current (i.e., discounted) amount. Management determines the fair value measurement on the basis of the value indicated by current market expectations about those future amounts.

Cost approach – This approach is a valuation technique reflecting the amount that would currently be required to replace the service capacity of an asset (i.e., current replacement cost).

The objective of using a valuation technique is to estimate the price at which an orderly transaction to sell the asset or to transfer the liability would take place between market participants at the measurement date under current market conditions. Management should evaluate the merits of the valuation techniques to determine which one to apply or whether to weight the results of different valuation techniques.

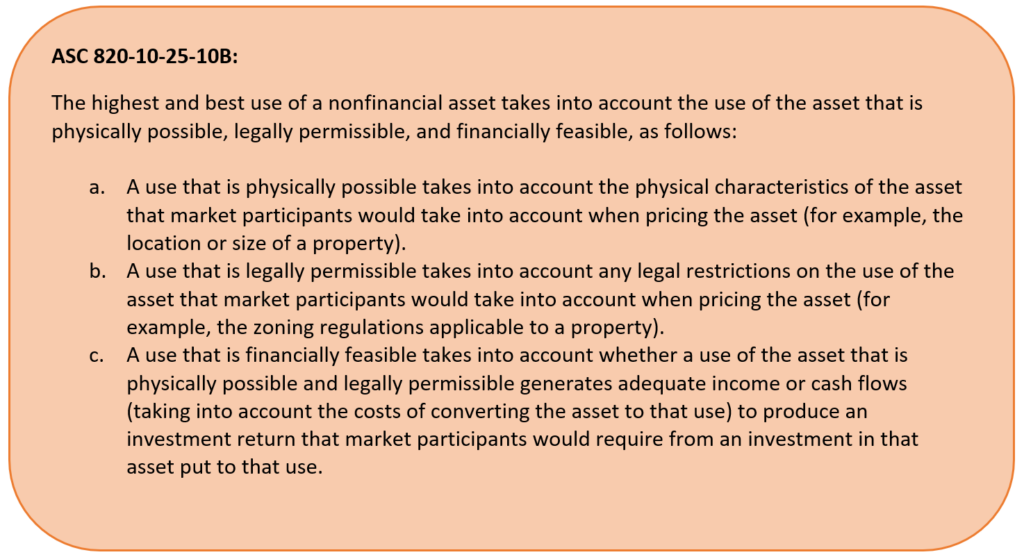

Highest and best use concept

When determining the fair value of a nonfinancial asset, it is important to base the measurement on the asset’s highest and best use.

ASC 820 requires that a fair value measurement of a nonfinancial asset take into account a market participant’s ability to generate economic benefits by using the asset in its highest and best use or by selling it to another market participant that would use the asset in its highest and best use.

The highest and best use of a nonfinancial asset might provide maximum value to market participants through its use in combination with other assets as a group (as installed or otherwise configured for use) or in combination with other assets and liabilities (for example, as a business).

Entities determine the highest and best use from the perspective of market participants.

Net Asset Value (NAV) as a practical expedient for fair value

Some reporting entities, such as investment companies, frequently invest in funds and other alternative investments. It is not easy to value alternative investments because sales are typically private and not available to the public.

These types of investments usually report Net Asset Value or NAV. NAV is the amount of net assets, recorded at fair value with changes in fair value recorded within profit or loss, attributable to each share, or unit, of the fund.

The FASB permits, but does not require, the use of NAV as a practical expedient for fair value if certain conditions are met.

IFRS does not contain a practical expedient for estimating fair value of certain investments using NAV.

Under U.S. GAAP, investors may use net asset value (NAV) to estimate the fair value of investments in investment companies that do not have a readily determinable fair value if:

- The investment does not have a readily determinable fair value

- The investment is in an or is an investment in a real estate fund for which it is industry practice to measure investment assets at fair value on a recurring basis and to issue financial statements that are consistent with the measurement principles in ASC 946

- The entity calculates NAV consistent with the measurement principles of ASC 946 as of the measurement date

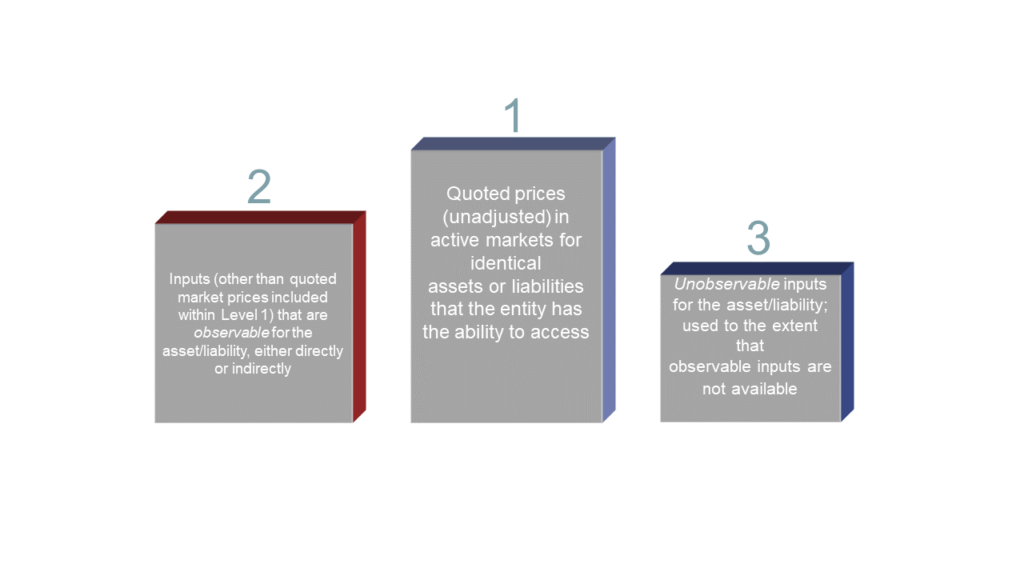

The Fair Value Hierarchy

To increase consistency and comparability in fair value measurements and related disclosures, ASC 820 establishes a fair value hierarchy. The hierarchy categorizes the inputs used in valuation techniques to measure fair value into three broad levels.

Entities categorize fair value measurements in their entirety based on the lowest level input that is significant to the entire measurement.

- Level 1: Quoted prices (unadjusted) in active markets for identical assets and liabilities that the reporting entity can access at the measurement date

- Level 2: Inputs other than quoted prices in active markets for identical assets and liabilities that are observable either directly or indirectly

- Level 3: Unobservable inputs

Accounting differences: ASC 820 vs. IFRS 13

Accounting for fair value measurements under U.S. GAAP and International Financial Reporting Standards remain predominantly aligned. IFRS 13, Fair Value Measurement, sets out the framework for measuring fair value under IFRS. It also defines fair value consistently with the definition under ASC 820. Still, although the standards are closely aligned, there are areas where divergence exists.

While not meant to be all inclusive, here are some of the key differences between ASC 820 and IFRS 13:

Day 1 gains and losses

Under U.S. GAAP, when companies must initially measure assets or liabilities at fair value, they immediately recognize any difference between the transaction price and fair value as a gain or loss in earnings—unless the relevant Codification topic requiring or permitting the fair value measurement states otherwise.

Under IFRS, entities cannot recognize inception gains or losses for a financial instrument unless a quoted price in an active market for an identical financial asset or liability provides fair value evidence, or a valuation technique uses only data from observable markets.

NAV as a practical expedient for fair value

The FASB permits but does not require the use of NAV as a practical expedient for fair value. However, this is only if certain conditions are met.

IFRS does not contain a practical expedient for estimating fair value of certain investments using NAV.

Online learning

GAAP Dynamics training courses help leading accounting firms and multinational companies move beyond the training status quo. We are constantly updating our existing courses and adding new courses, so check back often! Below are a few of our courses related to fair value measurements.

U.S. GAAP courses

eLearning

Fair Value: Overview of ASC 820 – Fair value is one of the most widespread financial concepts in U.S. GAAP? As such, this course is a must for any accountant or auditor! You’ll review the various balance sheet items which utilize fair value measurements. Next, this CPE-eligible, eLearning course (1.5 CPE) explores key concepts of fair value including:

- Utilizing market participant assumptions

- Distinguishing between orderly transactions versus forced transactions

- Using exit prices and not entry prices

- Determining the principal market

This online course then discusses the various approaches to determine fair value measurements. This includes the importance of inputs and their classification within the fair value hierarchy. The course concludes with a look at “real-life” fair value disclosures, highlighting the disclosure requirements within ASC 820.

Fair Value: Advanced Issues – You now have a good understanding of fair value accounting. It’s time to take your knowledge to the next level! The second course in our Fair Value Measurement series dives into advanced fair value measurement issues. Level up your fair value measurement accounting knowledge with advanced topics such as:

- Distinguishing, active, inactive and disorderly markets

- Using net asset value (NAV) as a practical expedient to fair value

- Considerations when determining the fair value of liabilities.

This online course is a must for any accounting, but especially those responsible for financial reporting or auditing financial institutions.

Microlearning

Fair Value: Restrictions on the Sale of Assets – How does fair value apply to assets whose sale is restricted? You will review the definition of fair value and the requirement within ASC 820 to consider market participant assumptions. Next, this microlearning course (0.2 CPE) presents a case study to determine whether a restriction is “entity-specific” or “security-specific.” After the case study, we provide helpful guidance in determining the type of restriction and the impact on estimating fair value. This online course concludes with providing examples of common restrictions and their effect on fair value of the related securities.

Fair Value: Hierarchy Issues – One of the main disclosure requirements of ASC 820 Fair Value Measurements is the fair value hierarchy. Such disclosures help users of the financial statements understand the inputs used to measure the fair value of financial instruments. In this CPE-eligible, microlearning course (0.2 CPE), we discuss the fair value hierarchy implications of “off-the-run” U.S. Treasury bonds, bonds priced using matrix pricing, and centrally-cleared derivatives.

We’ve bundled all these eLearning courses into a US GAAP fair value course collection for big savings!

IFRS courses

Fair Value: Overview of IFRS 13 – Entities report fair value measurement all over the financial statements. Yet, it is one of the most complex and judgmental areas of accounting! In this online training course (1.5 CPE), we explore key accounting concepts of fair value measurement under IFRS 13. This includes various methodology approaches, and required disclosures.

Accounting Resources

Resources from GAAP Dynamics:

We publish blog posts regularly on various accounting topics and issues. Stay updated by receiving an email notification as we publish new blog posts. Subscribe to our blog here: Subscribe to GAAPology